|

We are in a seller's market. Homes are selling quickly, but why are some homes selling well over their listed price while others sit longer on the market or even without a sale.? Every home is different, but Three major factors, location, condition and price, affect the sale of all homes.

Location is something we cannot change. As sellers, the two factors we can have the most influence over are condition and price. In the Calgary market three main condition factors are currently influencing the price sellers are getting for their property. Here are 3 factors to consider when you prepare your home for sale. Condition can be influenced by: 1. Curb Appeal First impressions matter. Ensure the exterior looks inviting with well-maintained landscaping, a clean facade, and appealing entryway. 2. Home Staging Stage the interior to showcase its potential. Remove clutter, depersonalize, and arrange furniture to highlight the space's functionality and flow. 3. Repairs and Maintenance Address any necessary repairs, from leaky faucets to structural issues. A well-maintained home gives buyers confidence and repairs left undone will leave buyers wondering if there are more unseen. The pricing strategy can also have a big influence on the outcome of a sale, especially in a market where prices are trending up. It can be very tempting to list a house higher than market value with the belief that buyer will pay more, but the problem with this strategy is that you put yourself into different group of buyers. If the market value of your home is $550,000 and you list it at $600,000, the buyers who come to see your home are expecting a $600,000 home. It would be better to list at $550,000 and get multiple buyers interested and willing to offer more to compete for the home. In addition to all of this, factors like bad DIY, unusual features, unpermitted work and outdated design Can also influence how quickly and for what price a home sells. Work with a real estate professional to set an appropriate listing price. It is possible to list your property at a higher price if the market conditions are right, but overpricing can deter buyers, while underpricing can lead to losses. If you want the best possible price for your home in this sellers market, make sure your home is looking its best and remember, accurate pricing is important. Today, I want to discuss four essential keys to successfully navigating the challenging terrain of a seller's market when buying a property. In a competitive environment like we have inCalgary today, where demand outweighs supply, it's crucial to be well-prepared with the right strategies to secure your dream home. Let's dive into the four keys that will help you unlock the doors to homeownership in a seller's market.

1. Be Prepared and Act Quickly: In a seller's market, time is of the essence. Being well-prepared and organized can give you a significant advantage. Start by getting your finances in order. Obtain a pre-approval letter from a reputable lender, which shows sellers that you are a serious buyer with the ability to secure financing. Additionally, define your search criteria and establish your non-negotiables early on. This way, when a suitable property hits the market, you can act swiftly, scheduling viewings, and submitting offers promptly. 2. Work with a Knowledgeable Real Estate Agent: Having a skilled and experienced real estate agent by your side is invaluable in a seller's market. Find an agent who specializes in the Calgary market and has a deep understanding of current trends and pricing. Their expertise and network can provide you with a competitive edge. They can help you navigate the fast-paced market, identify hidden opportunities, negotiate effectively on your behalf, and guide you through the entire buying process. 3. Be Flexible and Creative: Flexibility is key when buying in a seller's market. Prepare yourself mentally to be open to various possibilities. Understand that compromises may be necessary. Consider expanding your search area or exploring different property types. Be open to making cosmetic upgrades or renovations after purchasing to turn a less-than-perfect property into your dream home. Thinking outside the box and being creative can help you uncover hidden gems that others may overlook. 4. Offer Competitive Terms and Stand Out: In a competitive market, making a strong and compelling offer is essential. Start with a competitive price based on thorough market research and the advice of your real estate agent. Include favorable terms such as a larger earnest money deposit to show your commitment, flexibility with closing dates, or even waiving certain conditions of the sale if you feel comfortable doing so. However, consult with your agent to determine the best approach for your situation. Standing out from the competition can make sellers take notice and increase your chances of winning the bidding war. Buying a property in a seller's market can be challenging, but with the right strategies, it is entirely possible to find and secure your dream home. Remember to be prepared, act quickly, work with a knowledgeable real estate agent, be flexible and creative in your search, and make a strong, competitive offer. By employing these four keys, you'll position yourself ahead of the competition and increase your likelihood of success. Good luck on your homebuying journey! Calgary has much to offer. Recent data shows we have a comparatively low crime severity, We are the highest raked Canadian city on the EIU Livability Index, we are the 3rd best city in the world to find a job according to Movinga and we are the gateway to the Rockies with world class recreational opportunities.

According to the latest data from the Calgary Real Estate Board (CREB), the average price of a home in Calgary increased by over 9% between April 2020 and April 2021, 17% between April 2021 and April 2022 and an additional 1.2% between April 2022 and April 2023. Calgary has been experiencing steady population growth over the past few years. This growth can be attributed to the city's robust economy, excellent quality of life, and diverse range of cultural and recreational amenities. As more people continue to move to the city, growth will continue have an impact on the real estate market and housing prices will increase for the foreseeable future. Although that growth will have its highs and lows and values may fluctuate slightly, over time, we will see continued growth and long term property value appreciation. According to the latest census data, Calgary's population increased by over 14% between 2011 and 2016, bringing the total population to over 1.2 million people. This trend has continued in recent years, with a projected increase of over 16% by 2026. To put that in real numbers to digest, that is approximately 70 people per day. The city's growth rate is well above the national average, and this trend is expected to continue for the foreseeable future. A major factor driving this population growth is the city's strong economy. Calgary has a robust energy sector, with several multinational oil and gas companies having offices in the city. Although this sector has highs and lows that affect the economy, there is long term average growth. The city also has a thriving tech sector, with several startups and established companies choosing to base their operations in Calgary due to the favorable business environment and access to a skilled workforce. Add the growing supply chain infrastructure with procurement, logistics, and supply chain management are some of the fastest growing opportunities in the city. Calgary sits in the CANAMEX corridor from north to south and is a gateway on rail and highway corridors east and west A large part of my business, in the past few years, has been moving families to Calgary from out of province. They chose Calgary over their last home because they feel their quality of life for their family will be better here. As an aside, they often need work-from-home spaces. As more people continue to move to Calgary, there is a significant impact on the real estate market. We are experiencing that impact right now. The demand for housing has increased and the supply of homes has remained well below the 10 year average. This is resulting in higher prices for both rentals and purchases. Although we may not see this rate of growth consistently, from year to year, it is inevitable that property values in Calgary will continue to experience long term growth. Buying a home can be a daunting task, especially if you are a first-time homebuyer. The Canadian government has taken steps to make this process easier and more affordable through the introduction of the first-time home buyer’s tax credit.

The first-time home buyer’s tax credit was introduced in Canada in 2009 as part of the government’s economic action plan. It was designed to help first-time homebuyers offset some of the costs associated with buying a home. The tax credit provides eligible homebuyers with a non-refundable tax credit of up to $5,000, which can be claimed on their personal income tax return. To be eligible for the tax credit, you must meet certain criteria. First, you must be a first-time homebuyer or be purchasing a home for the first time in five years. Second, you must have a written agreement to purchase or build a qualifying home. Finally, you must intend to use the home as your primary residence within one year of purchasing or building it. Qualifying homes include new or existing single-family homes, semi-detached homes, townhouses, mobile homes, condominiums, and apartments. To qualify for the tax credit, the home must be located in Canada and must not have been previously owned by you or your spouse or common-law partner. The tax credit can be claimed by either the homebuyer or their spouse or common-law partner. The credit can only be claimed once and must be claimed in the year the home is purchased or built. If you are purchasing a home with someone else, such as a spouse or friend, the tax credit can be split between the two of you. The first-time home buyer’s tax credit can provide significant savings for eligible homebuyers. For example, if you purchase a home for $250,000, you could be eligible for a tax credit of up to $5,000. This could help offset some of the costs associated with purchasing a home, such as legal fees, land transfer taxes, and moving expenses. The first-time home buyer’s tax credit is a valuable tool for eligible homebuyers in Canada. It can provide significant savings and help make the process of buying a home more affordable. If you are a first-time homebuyer or are purchasing a home for the first time in five years, be sure to explore your eligibility for the tax credit and take advantage of this opportunity to save on your home purchase. Find out more details here: Line 31270 – Home buyers' amount - Canada.ca The federal government is offering a new tax credit to help make it easier for Canadians to care for adult relatives in their own homes. The multi-generational home renovation tax credit took effect Jan. 1 for expenses related to building a secondary suite for a family member who is a senior or an adult with a disability. The credit will provide a 15 per cent tax refund on expenses of up to $50,000 to a maximum of $7,500.

The secondary suite must be for a related adult over the age of 65 or living with a disability, including a grandparent, parent, child, grandchild, sibling, aunt, uncle, niece or nephew. The secondary suite must be a self-contained housing unit that includes a separate entrance, bathroom, kitchen and sleeping area. Additionally, the home being renovated must be inhabited or reasonably expected to be inhabited within 12 months after the end of the renovations. Certain things cannot be claimed, such as:

To find out more on the Government of Canada website CLICK HERE Here are 6 of the Canadian tax changes coming in 2023. They include everything from doubling the First-Time Home Buyer's Tax Credit to changes to Old Age Security and the Canada Pension Plan

New Tax Brackets These are the adjusted tax brackets for the 2022 tax year. These changes may mean paying a lower rate on more of your income.

The Basic Personal Amount, or BPA, is a non-refundable tax credit that can be claimed by anyone who files income taxes in Canada. The goal of the BPA is to give individuals making less than a certain amount a full deduction from income tax. Taxpayers who make more than this basic amount receive a partial reduction. The BPA is increasing to $14,398 for the 2022 tax year. First-Time Home Buyers’ Tax Credit doubled The First-Time Home Buyers Tax Credit, also known as the HBTC, is a federal government initiative to make homeownership more affordable for some Canadians. Eligible first-time home buyers can now claim a $10,000 non-refundable income tax credit — double what they could before — which could result in tax savings of up to $1,500.There’s no need to apply or be approved for the HBTC; just enter the Home Buyer’s Amount of $10,000 on Line 31270 of your income tax return. The credit will result in a rebate on taxes you owe. Old Age Security income limits changed Old Age Security, or OAS, is a government program that has been created to provide retired Canadians with a source of income to help throughout their retirement. However, seniors who make too much income are sometimes asked to pay back some of their OAS. The new thresholds for the 2022 tax year are as follows:

Canada Pension Plan earning and contribution increase Rules governing the Canada Pension Plan are changing in 2023. The new calculations are based on a CPP legislated formula that is based on the average growth rate of salaries and weekly wages earned throughout Canada. The maximum pensionable earnings under the CPP will be $66,600 in 2023, up from $64,900 in 2022. The basic exemption amount stays the same at $3,500 in 2023. CPP contribution rates have also been adjusted accordingly. Employee and employer contribution rates are now 5.95% (up from 5.70% in 2022) for a maximum contribution of $3,754.45. For self-employed individuals, the contribution rate will be 11.90% in 2023 (up from 11.40% in 2022) for a maximum contribution of $7,508.90. RRSP dollar limit increase The annual dollar limit for Registerd Retirement Savings Plans, or RRSPs, is $29,210 for the 2022 tax year, up from $27,830 in 2021. However, keep in mind that your individual contribution limit is still capped at 18% of your entire earned income. There are a number of influences in the market that will be pushing the direction prices move, and everyone has their opinion on where the market is going. Expert opinion seems to vary when it comes to predicting the future of the 2022 real estate market. The only point they all agree on is that there will be movement on price over the next 12 months.

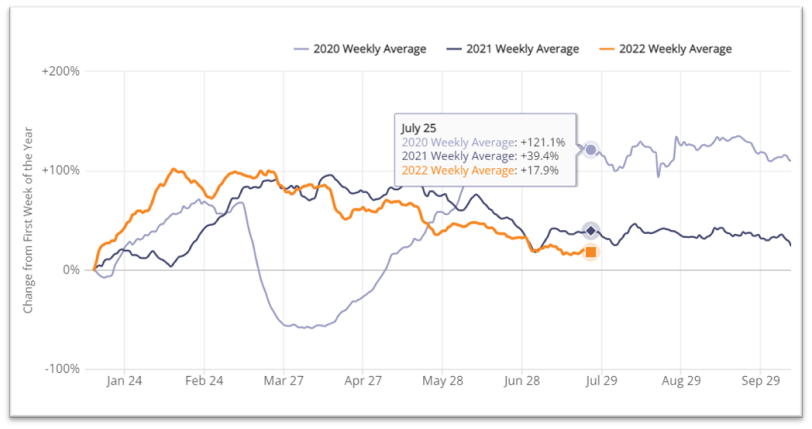

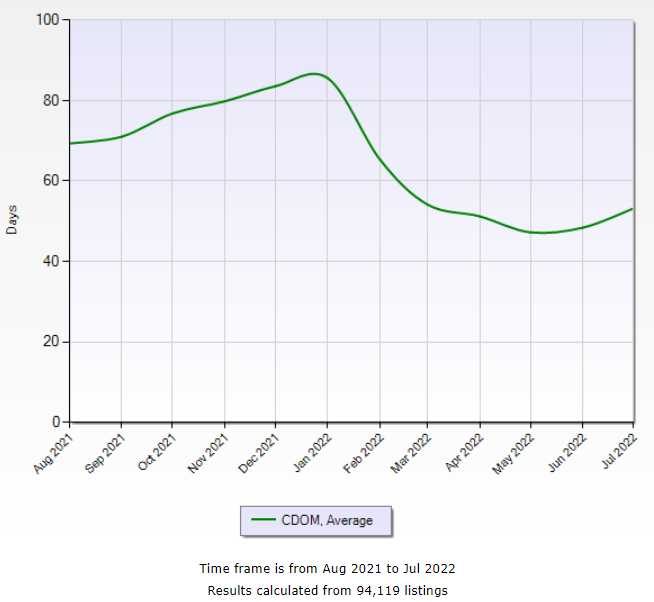

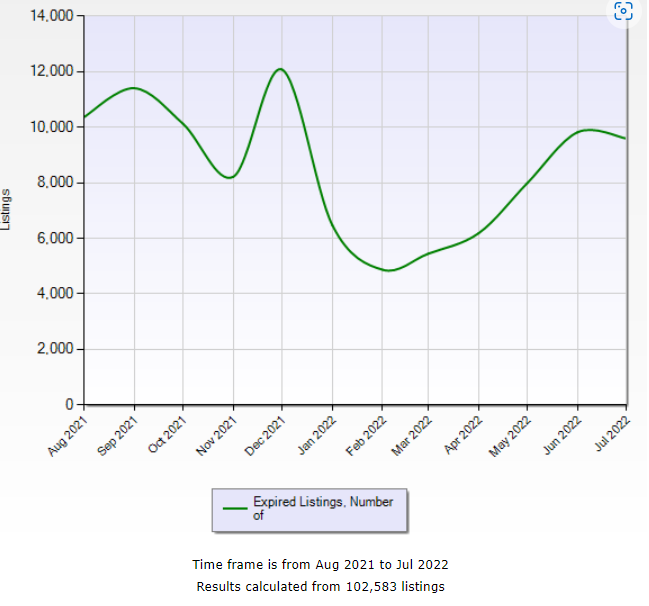

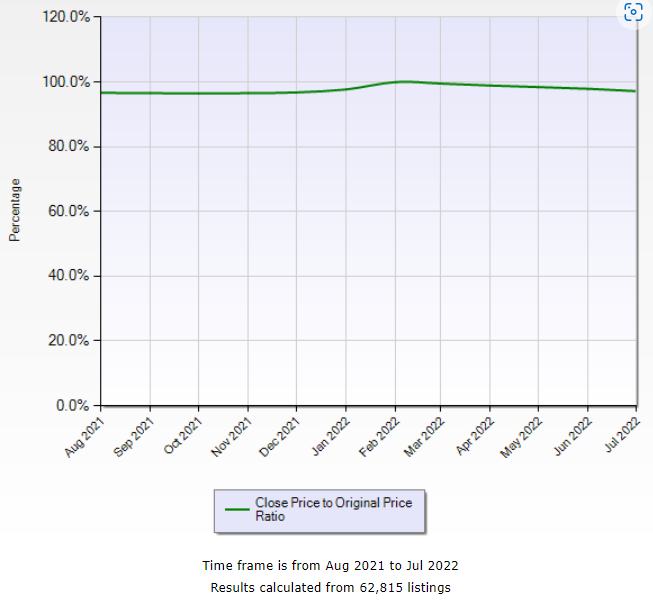

To price a home, we can analyze the market and take cues from these indicators to determine the most current local market trend. To get a home sold quickly for the best possible price it is important that we do not get behind the market. We don’t want to price it too low in an upward trending market or too high in a downward trend. As part of a Comparative Market Analysis where we look at past sales and current listings, the direction the market is currently trending informs on how a home should be priced. Let’s look at what current data is showing us as of today July 26, 2022. To price a property well, we don’t have to make wild predictions about where the market is going 6 months from now; we just have to know where the market is right now and where it is trending to help us determine a pricing strategy. Here are those 5 market indicators that can give us an understanding of the current state of the market. 1. Showing Activity As you can see from the chart below, showing activity in Alberta was trending down and appears to have leveled off, at least for the short term. 2. Days On Market The average days on market in the Greater Calgary Area has started to increase slightly. Based on the chart, This trend began in mid June after a hot market that initiated a downward trend in the number of days on market starting in January of this year. 3. Number of Multiple Offers Although this is something that is not tracked or charted, I have my own experience and anecdotal evidence from my fellow agents that the number of multiple offers has started to decline. There are still many properties being sold in multiple offer situations. At one time, earlier in the year, this was the norm. That is not the case at this moment in time. 4. Number of Expired Listings When prices are trending up or down, it becomes more difficult for agent to establish value when listing a property. We have seen several months of upward trending prices and as the market shifts, expectations for a higher priced sale may remain beyond the point of the shift. The number of expired listings in the Calgary Area does not seem to be showing a significant trend, but seems to have leveled off and even show a slight decrease in July. This would indicate we may see a slow down in the upward trend of pricing, but there is currently no definitive indicator that would lead us to believe prices are currently trending down. 5. Number of Price Reductions The number of listed homes making price reductions is another indication of a pricing trend. In this chart we are looking at the selling price compared to the original listed price. As you can see by this chart, there does not seem to be a significant trend coming into play at this point in time. Sellers are holding firm on their prices Where does that Leave Us? What can we say about the current state of the market? The number of showings are down from their peak in March. Days on market are going up slightly and the number of multiple offers has decreased, but they are still happening with desirable properties. The number of expired listings is reasonably unchanged but could be hinting at an upward trend and the selling price to listing price ratio seems to have normalized. The data from these 5 indicators seems to be showing us the market has no definite trend, but we seem to be at a turning point from rapid price escalation. We are coming out of a steep upward trend with all indicators leveling off.

Where we go from here depends on certain influencing factors.

This is question that is on a lot of peoples minds right now. Is the market going to get better for buyers or is it going to stay a sellers' market for some time? I do not believe we are in a real estate bubble. We are going to see interest rates go up so buying now versus holding off and waiting for the bubble to burst is likely going to put buyers in a position of paying the same price or more but at a much higher interest rate.

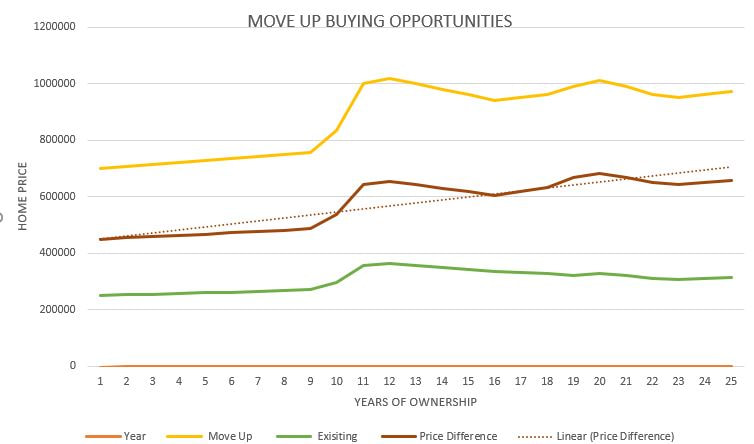

The current high prices are result of a lack of inventory, not speculative buying. We are not seeing an influx of investment buyers purchasing property. We are seeing families in need of a home bidding on property and driving up the cost of housing. It is a supply-demand economy. Of the five houses I sold this January, all were families looking to move. The lead-up to the housing collapse in the 4th quarter of 2007 saw speculation and over-extended credit as major factors that artificially inflated prices. At the time, mortgages were much easier to qualify for and that easy money brought more buyers and speculators into the market. Now lenders are taking fewer risks and are much more strict when qualifying buyers. Foreclosures in 2021 dropped to the lowest rate since 2005. So What we are experiencing now is the opposite of 2007. We are in a market driven by scarcity. At this point in time, the market appears to be sustainable. I leave it up to you to decide if you should buy now or wait, but I believe waiting will cost buyers money due to the higher interest rates coming throughout 2022. If you are thinking of moving up to a bigger home, now is the time. We are currently in a buyers' market in Calgary. There are more homes coming onto the market than are being sold and buyers have the advantage of selection. Typically, in a buyers' market, prices will be stagnant or will fall. This can cause home owners, looking to move to a larger home, to pull back from selling because they are concerned that they will not get as much for their home as they would have in the past. Moving up is the norm for a maturing family. Most often, a first time buyers will purchase a smaller home. They do not need a lot of space and the smaller home is more affordable. As the family grows and the family income grows a larger house becomes more affordable and even necessary for the larger family. When are the best opportunities in the market to make this move up to a larger home? Let me explain why a buyers' market is the best time to move up to that next home: The graph above shows how home owners are presented with opportunities to “buy up” to their next home. The green line represents the value of the existing home, the yellow line, the value of the move up home and the red line represents the difference in price between the two homes. In this chart, the percent value change is the same for both the existing and the move up properties. When one increases by 2%, so does the other. That is generally the way the market reacts. Notice that as the market matures throughout this 25-year period, even though the percentage in value increase stays the same for both homes, the dollar value of the higher priced home increases more. Now let's look at the price difference. This is the critical factor that can influence the buying decision for people moving up. It makes sense to move up when the difference is at the least amount. The dotted red line shows the upward trend in price difference, where the solid red line shows the actual difference in price. As you can see, there are times where the actual difference is above or below the trend line. When prices are stagnant or dropping, the price difference is lower than the trend and when prices are increasing, the actual difference is above the trend line. If the owner of the existing property wants to take advantage of the best opportunities to move up they need to make a move when the market shows the least difference in price. They should make their purchase when the actual price difference is below the trend line or when prices are either flat or are falling. This would be during a buyers' market. Calgary is currently in a buyers' market and the June 2018 sales in Calgary paint a good picture for move up buyers for the next few months. If you are selling a home in the $300,000-$500,000 range, you can see that sales volumes in these price ranges are much stronger than in the move up ranges of $500,000 and up. There are certainly more people looking for houses and buying houses in the starter home range. This translates into a better buying price for the move up home and a good selling price for the seller's home. These appear to be excellent market conditions to make the move to a larger home. Feel free to contact me if you have questions. If you are thinking of selling, I would be happy to do a comparative market analysis of your home.

There are many things to consider when renovating a home. What should I renovate to get the best return? Wall colours, flooring types, cabinet styles…The list goes on and on. There are also a few simple rules that need to be followed. Doing a great, professional job is among them, but the single most important rule is “Do not over develop”.

Here is an example that will illustrate my point. The current market value of a house is $400,000. The owners decides to do a complete renovation of the home. New roof, new windows, new mechanical, new kitchen, new baths, new flooring, new lighting, new baseboards, trim and doors are all on the list of things the owners wants to do. The budget for the renovation is $130,000 dollars. After the renovation the owners have a beautiful home and they lists the house at $570,000, hoping to gain a profit and get paid for the hard work, time and effort of renovating. The house sits on the market for months with very little interest and they finally have to take it off the market or lose money on the endeavour. What went wrong? Before the renovation begins, the owners should have researched to find out what the market value of the house will be when the renovation is complete. If the completely renovated house in their neighbourhood has a market value of $500,000, the owners will be out $30,000 in equity for the house and they gain nothing from the work that was completed. There is a difference between the cost of the renovation and the value of the renovation. I know this does not seem fair, but it is one of the realities of the real estate market. Cost and value are independent of each other in the real estate market. There are definitely situations where cost is lower than value. Those are the properties that people who flip houses search for. It is a very competitive market for those homes. I have seen a similar over development and wasted renovation dollars in neighbourhoods where there is prevalent infill redevelopment. Home owners, knowing properties in the neighbourhood are in high demand, will renovate their home to try to maximize their return when they sell. They might do a few simple updates like a fresh coat of paint and some new carpet and maybe even replace the worn-out roof. They might spend anywhere from $5000 - $15,000. At the time of sale, they end up getting a similar selling price to the neighbour who did not renovate before they sold. Why did this happen? Because the highest and best use for the property is redevelopment. Properties are being purchased in the area for the value of the land and the condition of the home has little effect on the value of its highest and best use. My best advice for people who want to renovate is to understand the context of the market and know the market value of a property before a renovation begins. Then be sure to understands how the renovation affects the market value. Don't assume that a there will be a profit for a renovated property or even a 100% return on the renovation dollars spent. In Calgary as in most cities, the closer to the core you go, the more valuable a renovation is, except in neighbourhoods where the zoning makes highest and best use of most properties, redevelopment. But even in neighbourhoods where this is true, certain properties can still benefit from renovating because not every property in those neighbourhoods has redevelopment as its highest and best use. You might be asking a few questions after reading this. 1. How can I avoid over developing my property? Engage the services of to a real estate appraiser to learn what the property is worth now and what it will be worth once it the renovation is complete. This may cost a few hundred dollars, but in the end, it could save thousands. As an alternative, If you are planning to sell after the renovation, get advice from a real estate professional like me who can explain the market and help you make some decisions. 2. What renovations should you do to get the best return? That is another blog topic to come. That really depends on your house and what it needs. Generally, I would say that the roof, windows, siding and mechanical should be your starting point. If all of those are OK, the rest depends on your budget. Some house flippers just do cosmetic changes (Commonly know as lipstick on a pig) and seem to profit. I like to steer my buyer clients away from these properties unless they are willing to take on the big ticket costs after they buy. Feel free to contact me if you have questions. If you are renovating to sell, I would be happy to do a walk through of your home and advise you on the best place to spend your money to get the best return on your renovation dollars.

Want to learn more about the value of your house?

Jim Perks is a REALTOR in Calgary, Alberta, Canada. He uses his expertise in Internet marketing and real estate experience to service both buyers and sellers throughout the city of Calgary. He can be reached at RE/MAX Real Estate (Mountain View) 403-247-5178 or by email at jim@jimperks.ca. His website is www.calgaryrealestateagent.ca

|

AuthorJim Perks is a Calgary REALTOR who divides his time working with both sellers of houses and buyers of homes. He has been an agent since 2010 Archives

September 2023

Categories

All

|

RSS Feed

RSS Feed