|

The federal government is offering a new tax credit to help make it easier for Canadians to care for adult relatives in their own homes. The multi-generational home renovation tax credit took effect Jan. 1 for expenses related to building a secondary suite for a family member who is a senior or an adult with a disability. The credit will provide a 15 per cent tax refund on expenses of up to $50,000 to a maximum of $7,500.

The secondary suite must be for a related adult over the age of 65 or living with a disability, including a grandparent, parent, child, grandchild, sibling, aunt, uncle, niece or nephew. The secondary suite must be a self-contained housing unit that includes a separate entrance, bathroom, kitchen and sleeping area. Additionally, the home being renovated must be inhabited or reasonably expected to be inhabited within 12 months after the end of the renovations. Certain things cannot be claimed, such as:

To find out more on the Government of Canada website CLICK HERE This is question that is on a lot of peoples minds right now. Is the market going to get better for buyers or is it going to stay a sellers' market for some time? I do not believe we are in a real estate bubble. We are going to see interest rates go up so buying now versus holding off and waiting for the bubble to burst is likely going to put buyers in a position of paying the same price or more but at a much higher interest rate.

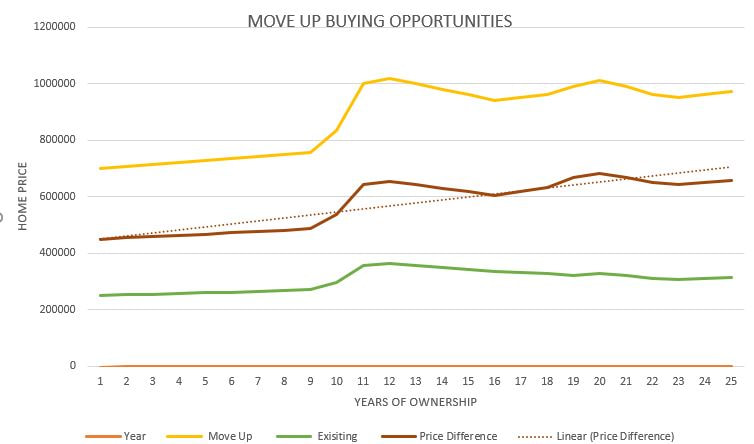

The current high prices are result of a lack of inventory, not speculative buying. We are not seeing an influx of investment buyers purchasing property. We are seeing families in need of a home bidding on property and driving up the cost of housing. It is a supply-demand economy. Of the five houses I sold this January, all were families looking to move. The lead-up to the housing collapse in the 4th quarter of 2007 saw speculation and over-extended credit as major factors that artificially inflated prices. At the time, mortgages were much easier to qualify for and that easy money brought more buyers and speculators into the market. Now lenders are taking fewer risks and are much more strict when qualifying buyers. Foreclosures in 2021 dropped to the lowest rate since 2005. So What we are experiencing now is the opposite of 2007. We are in a market driven by scarcity. At this point in time, the market appears to be sustainable. I leave it up to you to decide if you should buy now or wait, but I believe waiting will cost buyers money due to the higher interest rates coming throughout 2022. If you are thinking of moving up to a bigger home, now is the time. We are currently in a buyers' market in Calgary. There are more homes coming onto the market than are being sold and buyers have the advantage of selection. Typically, in a buyers' market, prices will be stagnant or will fall. This can cause home owners, looking to move to a larger home, to pull back from selling because they are concerned that they will not get as much for their home as they would have in the past. Moving up is the norm for a maturing family. Most often, a first time buyers will purchase a smaller home. They do not need a lot of space and the smaller home is more affordable. As the family grows and the family income grows a larger house becomes more affordable and even necessary for the larger family. When are the best opportunities in the market to make this move up to a larger home? Let me explain why a buyers' market is the best time to move up to that next home: The graph above shows how home owners are presented with opportunities to “buy up” to their next home. The green line represents the value of the existing home, the yellow line, the value of the move up home and the red line represents the difference in price between the two homes. In this chart, the percent value change is the same for both the existing and the move up properties. When one increases by 2%, so does the other. That is generally the way the market reacts. Notice that as the market matures throughout this 25-year period, even though the percentage in value increase stays the same for both homes, the dollar value of the higher priced home increases more. Now let's look at the price difference. This is the critical factor that can influence the buying decision for people moving up. It makes sense to move up when the difference is at the least amount. The dotted red line shows the upward trend in price difference, where the solid red line shows the actual difference in price. As you can see, there are times where the actual difference is above or below the trend line. When prices are stagnant or dropping, the price difference is lower than the trend and when prices are increasing, the actual difference is above the trend line. If the owner of the existing property wants to take advantage of the best opportunities to move up they need to make a move when the market shows the least difference in price. They should make their purchase when the actual price difference is below the trend line or when prices are either flat or are falling. This would be during a buyers' market. Calgary is currently in a buyers' market and the June 2018 sales in Calgary paint a good picture for move up buyers for the next few months. If you are selling a home in the $300,000-$500,000 range, you can see that sales volumes in these price ranges are much stronger than in the move up ranges of $500,000 and up. There are certainly more people looking for houses and buying houses in the starter home range. This translates into a better buying price for the move up home and a good selling price for the seller's home. These appear to be excellent market conditions to make the move to a larger home. Feel free to contact me if you have questions. If you are thinking of selling, I would be happy to do a comparative market analysis of your home.

|

AuthorJim Perks is a Calgary REALTOR who divides his time working with both sellers of houses and buyers of homes. He has been an agent since 2010 Archives

September 2023

Categories

All

|

RSS Feed

RSS Feed